“Creatives should also be able to share in the wealth that is created from their work.”

This simple belief…

It underpins the Creative Capital model. It stems from a recognition that creative expertise*, when properly applied, generates business value. Therefore creative expertise can be considered an asset. On the one side an asset that can be bartered for a share in the value it creates, and on the other an asset that can be invested in for a share in that value.

For example...

EXAMPLE CORP employs ACME INC, a digital consultancy to leverage its unique expertise to help build its new core product. As a part of that deal EXAMPLE CORP gives ACME INC X% of equity in the company. In doing so, EXAMPLE CORP has aligned incentives, hedged its risk, and reduced its time to market. Both can go on to benefit from the future success of the product and company.

*The Creative Capital model relies on generating exploitable knowledge and information. It has a natural home in knowledge economy creative industries such as Advertising and Marketing, Architecture, Design, Film, Gaming, IT/Software, Publishing, and Music. Creative expertise in the knowledge economy runs far wider into the field of law and business strategy.

Why ‘Creative Capital’?

The equity-for-services, or ‘sweat equity’, model is not new. Many operators including individuals, businesses, and industries have engaged this model, exchanging expertise in return for a share in the value it creates. That share can come in the form of equity, royalties, or a profit share (you can get creative with it). Such arrangements in the creative field are often considered as ‘alternative revenue’ arrangements alongside the prevalent ‘paid-for-time’ consultancy model.

The term Creative Capital…

properly recognises the potential value impact of creative expertise.

decouples the value of creative expertise from the time it takes to deliver it

allows the diverse creative community to come together and ‘own’ the model and to define the terms of business.

establishes conventions and expectations around the model for creators, buyers, and investors.

clears the path towards larger brands and enterprise to ultimately engage the model.

Barter Types

EQUITY

Equity/Cash Blend

Royalties

Profit Share

8 Conventions in Creative Capital

1.

Excellence Required

Excellence is a prerequisite for being able to trade expertise for a share of upside. If the services can be easily found and paid for then the terms will default to ‘paid-for-time’.

2.

Reserves Required

Engaging the Creative Capital model alongside a ‘paid-for-time’ model requires significant capital reserves as the potential rewards are many years out.

3.

Often Equity Cash Blended

Many companies opt for cash plus equity deals when engaging the model in order to offset costs, plus establish a two-way ‘skin in the game’ relationship.

4.

VC Like Strategy

Like the VC model, you have to place a lot of bets for this to pay off (Check out power law). A creative company can realistically place only so many bets.

5.

Independence Required

The model seems to be primarily employed by independent companies. The risk/reward profile is not appealing to group owners focused on short term cash generation.

6.

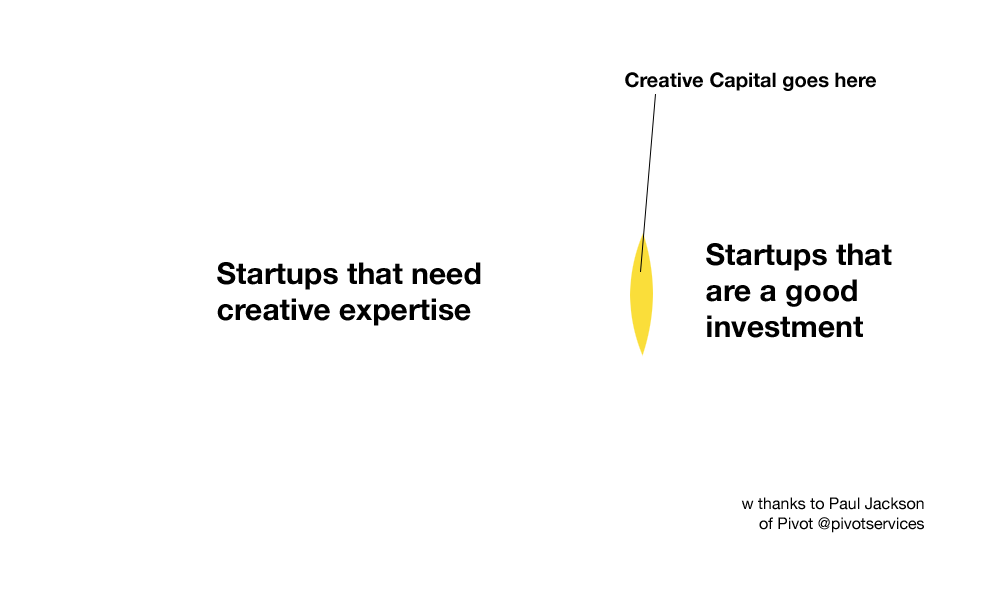

Biased Towards Startups

Progressive models are always easier to negotiate with startups and younger companies. Currently enterprise brands and their legal departments are rarely able to countenance this model.

7.

Patience Required

The returns from a creative capital deal are often reliant on a liquidity event 5 to 10 years out. That requires patience and a long term mindset.

8.

Moving To A Funded Future

The next evolutionary step for the model is to provide investment funding to companies engaged in the Creative Capital model.

BENEFITS of Creative Capital

For Buyers

Hedge risk

Align incentives with your partners

Reduced TTM. Faster route to product and market

Tap into ‘unhirable’ outside resources

Alternative to VC route

Stealth, work under the radar

For Sellers/Creative Experts

An emerging industry model for the creative class

Opportunity to capture share in value your work creates

Opportunity to diversify revenue model

Capture high growth opportunity available to accredited investors

RISKS of

Creative Capital

Should not be be universally employed. It is an emerging option alongside established models.

Not every company is suitable for investment, especially in return for equity.

It is RISKY. Health warning attached. Most startups fail.

Long path to return on investment. Being paid cash for your expertise is good for business too.

Tax/legal implications and costs to be considered in any deal.

The Operators: Creative Firms Who Have Done Creative Capital Deals

Creative Capital is a mutual investment decision. Inclusion on the list below does not mean there is a guarantee of engaging the model with the firm. The operators below are not to be confused with venture/startup studios who build their own startups. Please reach out if you would like to be be listed/unlisted.

Product & Strategy

- Apply Digital

- Argo Design

- Astro Studios

- Aug Ventures

- Bakken & Bæck

- BCG Digital Ventures

- Bionic

- Bothrs

- BASIC

- Clearleft

- co:

- CoMedia Design

- Dynamo Partners

- Fictive Kin

- First Principle

- FKTRY

- FROG

- Funsize

- GoKart

- Human

- IDEO (PilPak)

- Inamoto & Co

- Josephmark

- Ming Labs

- Ministry Of Programming

- Originate

- Pivot Venture Services

- PURE

- R/GA

- RIOT

- SURFnCODE

- Think Craft

- Thinktiv

- Topmonks

- TWG

- ustwo (DICE)

- Work&Co

- Your Majesty Co.

- Zensite

Full Stack

Hardware / Industrial

Branding

- Dear Future

- Gin Lane (Pattern Brand)

- Monopo

- Partners & Spade (Harry's)

- Proxy Ventures

- Red Antler (Casper)

Marketing / Advertising / PR

- And Rising

- Anomaly

- Derris

- NEWS (Japan)

- Tusk

- WEST

- Wolves, Not Sheep

Legal / Regulatory

Articles / Press on Creative Capital

Follow and join the conversation on Twitter at @CreativeCapital

- Creative Capital is the secret sauce, not venture capital Techcrunch

- Design agency focuses on investments (Dovetail) Kampanje

- The Cult Brand Whisperer Behind Casper, Allbirds, And Birchbox / Fast Company

- Meet the Surprisingly Small Group of Branding Shops Behind Today’s Top Challenger Brands / Adweek

- The PR agency execs behind Warby Parker have raised $10 million to fund the next Warby Parkers / recode

- Exclusive: Foursquare’s President Starts New Early-Stage Venture / Fortune

- Should Agencies Exchange Services for Equity in a Startup? / LTV with Kyle Racki

- The Top 5 Considerations When Trading Equity For Services / Forbes

- Meet the Man with the Midas Touch - Yves Béhar / Entrepreneur

- The benefits and risks of consulting for equity / wework Creator

- Skin in the Game / 99U

- Equity Investing is Expensive, Risky, and Slow—So Why Are All These Designers Trying to Become Venture Capitalists? / AIGA

- Is Giving Away Equity Worth the Risk? / Inc.

- Why “paid for time” is the biggest problem of the creative industry / Beyond Users

- On Venturing pt 1 / Hackernoon

- On Venturing pt 2 / Hackernoon

- Turning The Digital Product Studio On Its Head / Track Changes

- Macquarie Capital Venture Studio adds three new companies to infrastructure tech portfolio / TechCrunch

- Launching NEWS, an expert group investing creativity into startups / TechCrunch Japan

- Frog debuts a radical new business model. Can it save independent design? Fast Company

- How insurance startup Hippo built a company worth $1 billion (Work&Co) ModernRetail

- When Metalab rejected Slack’s equity offer NextBigWhat

- Dog treats subscription service BarkBox to go public via a $1.6 billion SPAC merger (PreHype) Business Insider

- College Dropout Makes Market Debut With Tiny Tech SPAC (MetaLab) Bloomberg

Resources

This site serves as a free information resource for the Creative Capital model. Sample legal frameworks, case studies, and FAQs will be added over time.